Diversify for the Right Reasons

We believes our unique ability to invest throughout the capital stack – common equity, preferred equity, mezzanine debt, and debt – and through both privately or publicly investments, allows us to best capitalize on market opportunities and pricing inefficiencies. Our approach is to seek out the optimal investment solution in order to maximize returns while minimizing risk.

Private Equity Investment Approach

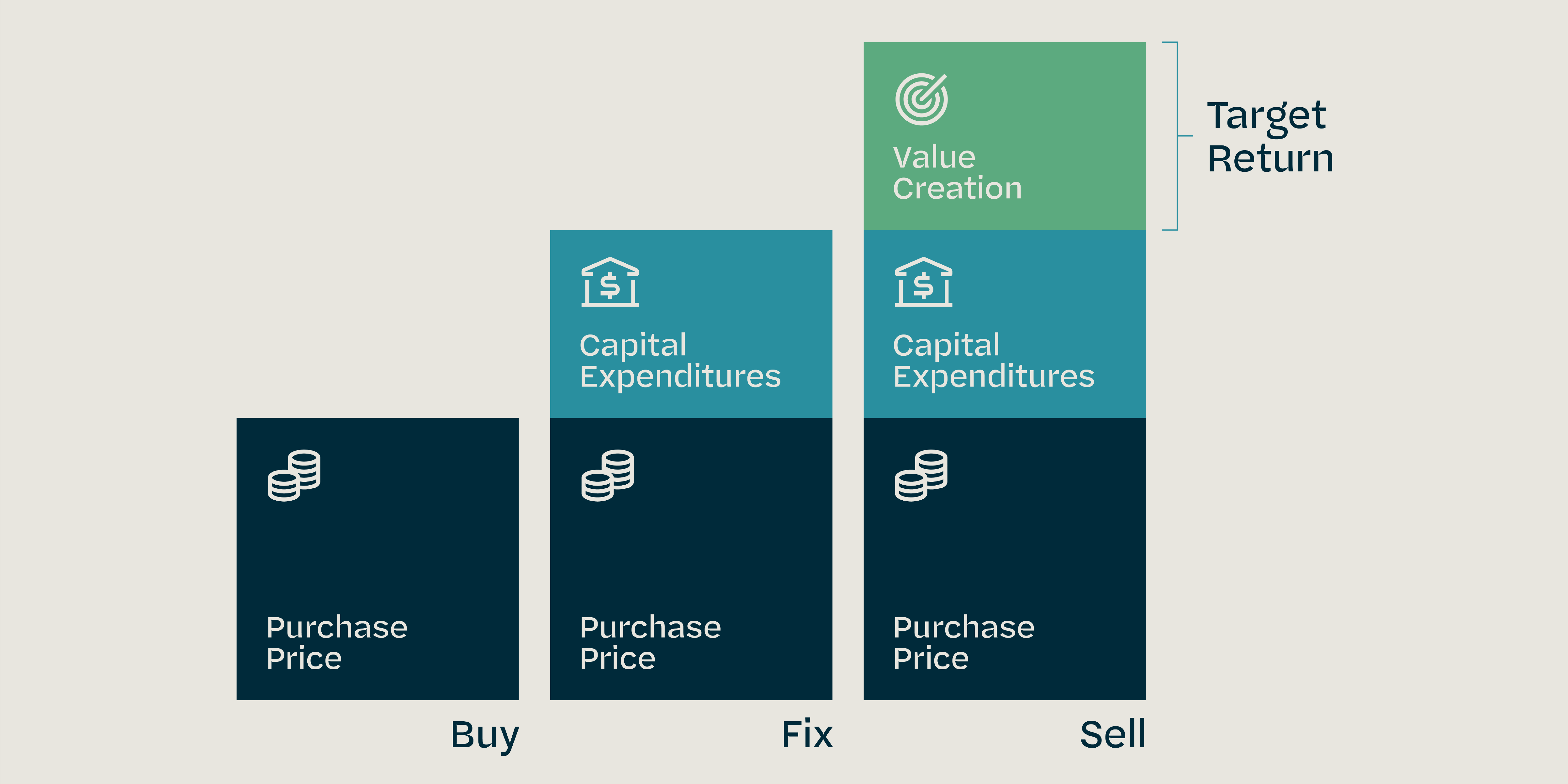

We target core, value-add, and opportunistic real estate opportunities directly and through privately held companies where we employ various strategies including:

Asset Repositioning

Investments in assets where significant renovations are required to improve the competitiveness of the asset which is expected to lead to one or more of: higher rents, lower operating costs, lower cap rate and ultimately higher value.

Lease-Up

Investments in assets with in-place or upcoming vacancy where value can be added by repositioning and releasing the asset.

Development

Investments in ground up developments with established and reputable, sponsors in liquid markets with attractive fundamentals.

Distressed

Investments in assets experiencing problems as a result of an over-levered capital structure or mismanagement at the property level.

Growth Equity

Investment in an asset or company that provides the existing owner with the capital needed for acquisitions, development and/renovations.

Asset Repositioning

Investments in assets where significant renovations are required to improve the competitiveness of the asset which is expected to lead to one or more of: higher rents, lower operating costs, lower cap rate and ultimately higher value.

Lease-Up

Investments in assets with in-place or upcoming vacancy where value can be added by repositioning and releasing the asset.

Development

Investments in ground up developments with established and reputable, sponsors in liquid markets with attractive fundamentals.

Distressed

Investments in assets experiencing problems as a result of an over-levered capital structure or mismanagement at the property level.

Growth Equity

Investment in an asset or company that provides the existing owner with the capital needed for acquisitions, development and/renovations.

When analyzing private equity investments, we focus on investments where we believe value can be created based on improvements to net operating income and which is not dependent on improvements in market valuations to drive the value of the investment.

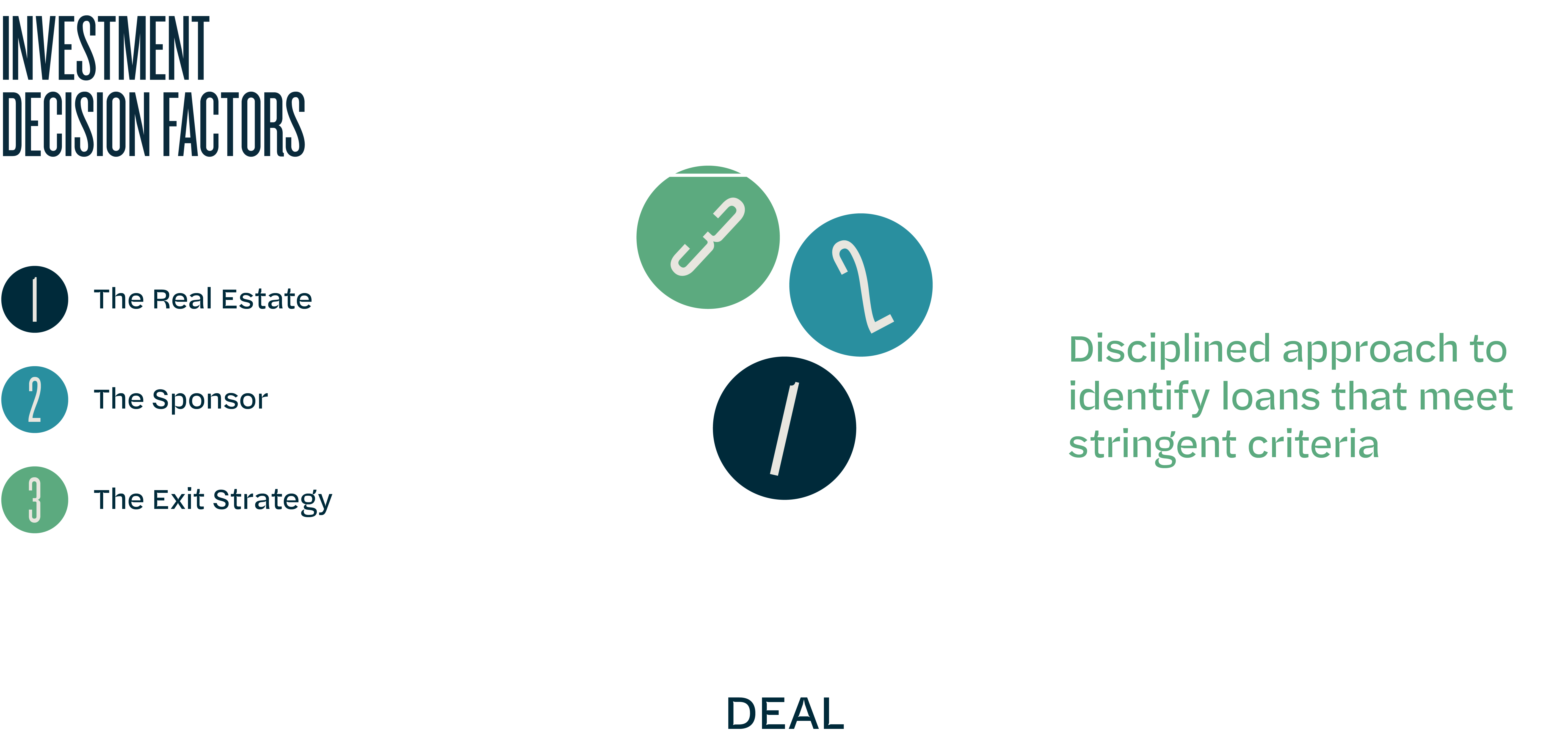

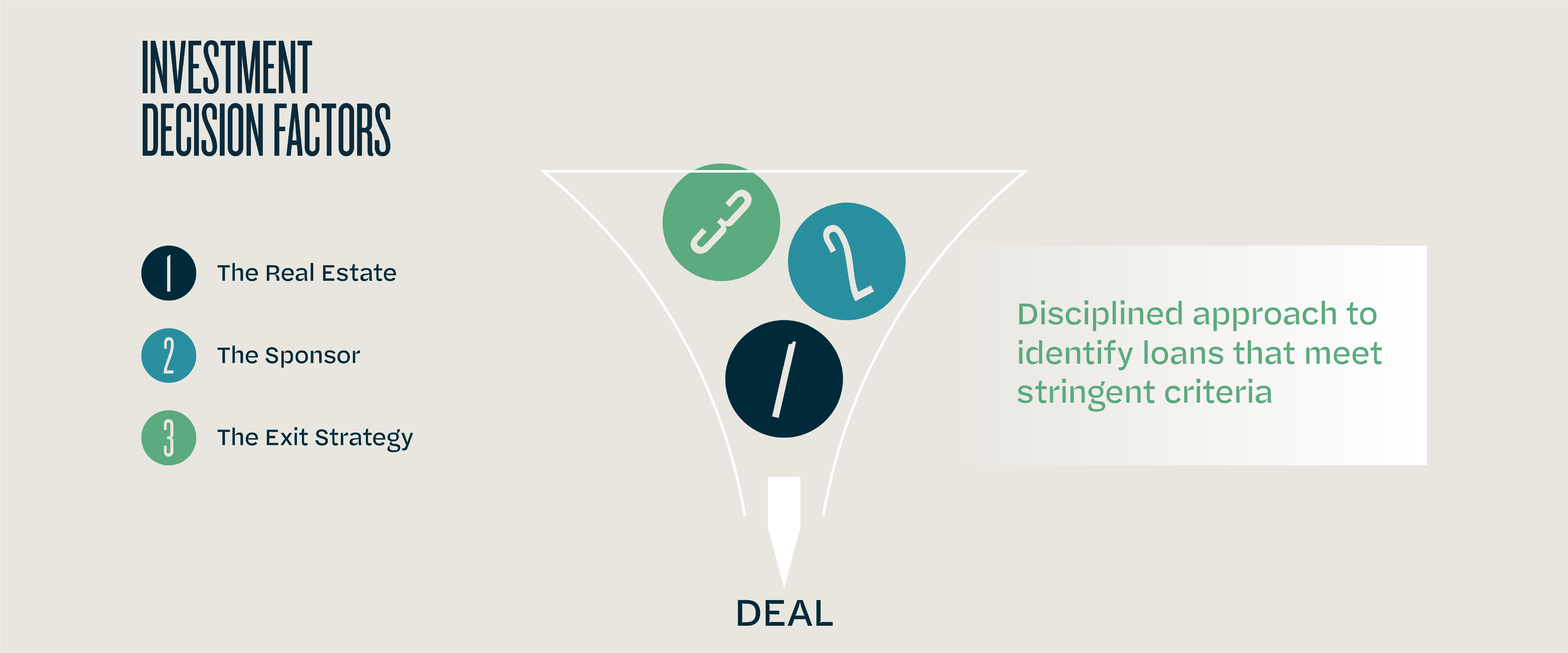

Private Debt Investment Approach

We target private debt investment opportunities where we believe the investment’s yield is greater than the underlying risk of the investment. Specifically, we target unconventional loans that provide solutions to real estate investors that are not currently satisfied through conventional providers of financing - banks, insurance companies or pension funds. Unconventional loans are typically characterized as loans having:

- Terms of between three months and five years

- Principal balances of less than fifteen million dollars

- Interest only structures

- Flexibility to repay the loan at any time

These loans are used by real estate investors to:

- Facilitate property acquisitions

- Fund value enhancement strategies designed to improve occupancy and NOI

- Fund capital restructuring events

- Terms of between three months and five years

- Principal balances of less than fifteen million dollars

- Interest only structures

- Flexibility to repay the loan at any time

These loans are used by real estate investors to:

- Facilitate property acquisitions

- Fund value enhancement strategies designed to improve occupancy and NOI

- Fund capital restructuring events

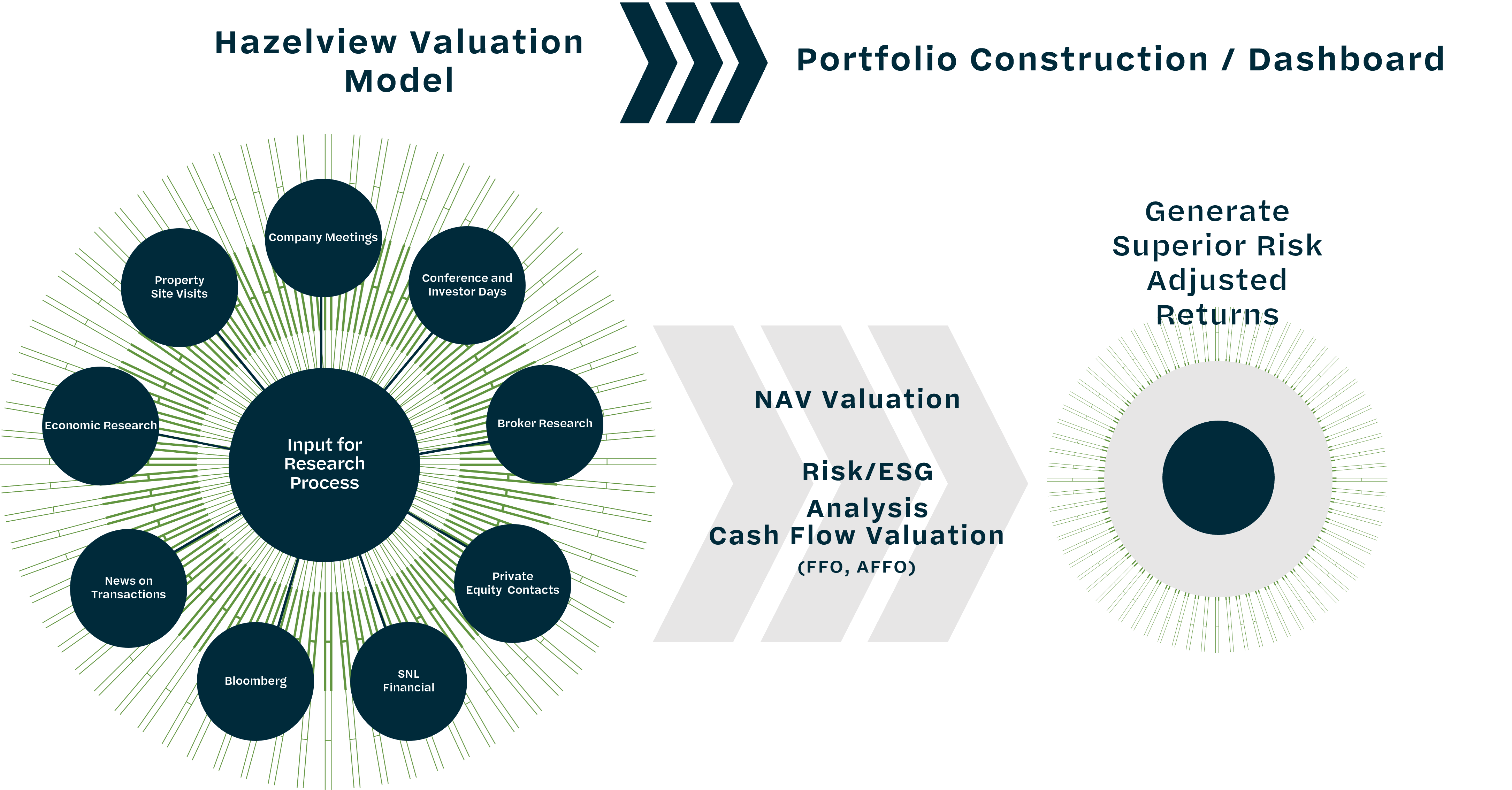

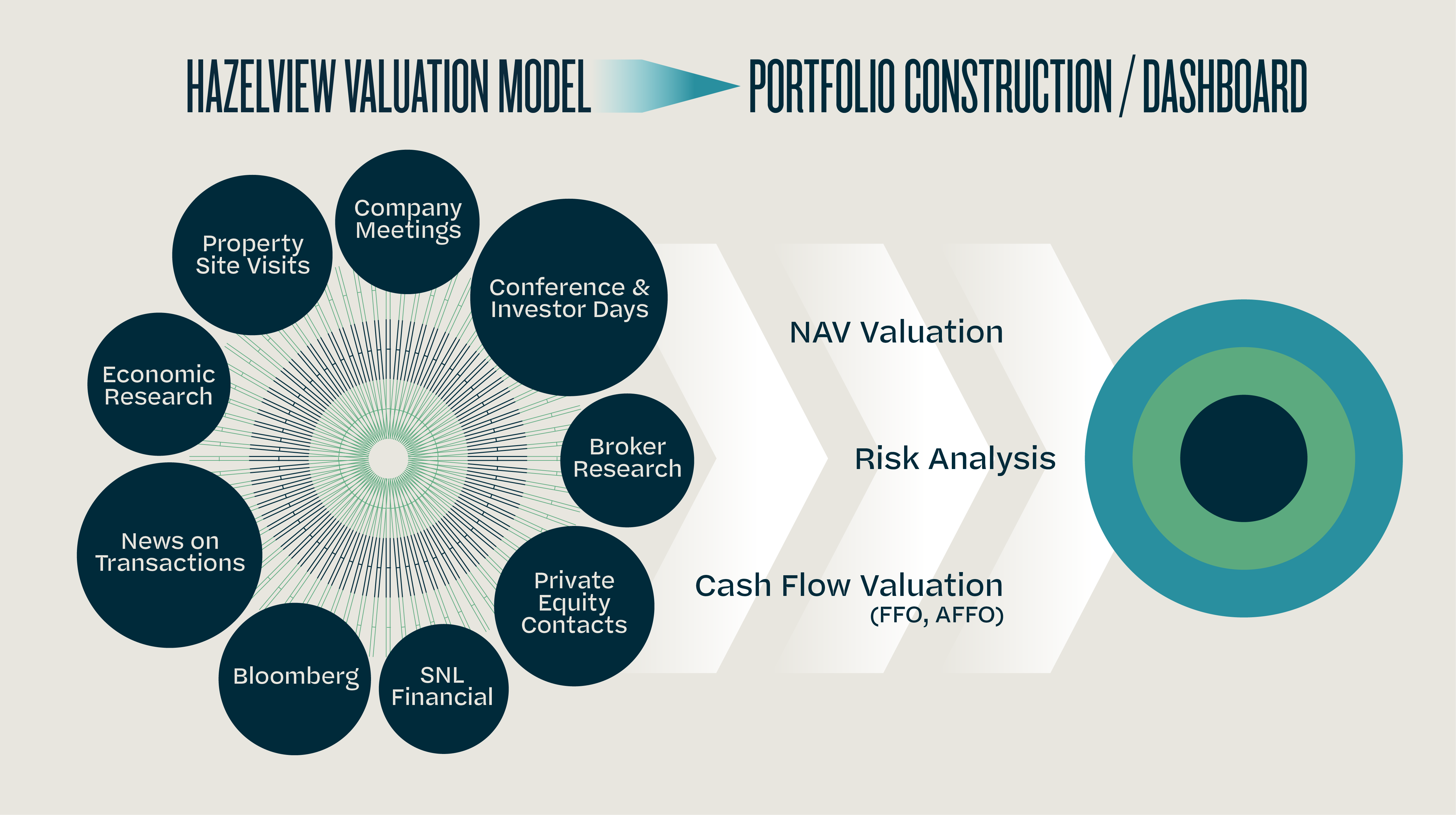

Public Real Estate Investment Approach

Our philosophy to investing in REITs is based on the premise that investors look to REITs as a way to get exposure to real estate with liquidity and/or to generate income with low correlation characteristics. Our job is to build portfolios that mimic the experience of owning direct real estate but through liquid securities. Specifically, we seek to identify opportunities where we feel pricing in the public markets are inefficient relative to that of the direct real estate or broader equities markets.

Our investment process is research driven and begins with understanding the real estate. We leverage numerous sources to:

- Establish a view of where real estate markets are today and where they will be in the future

- Establish a concrete understanding of a company’s strategy

- Establish a view on the quality of management

- Establish a view on the quality of the underlying real estate and cash flow stream

Our investment process is research driven and begins with understanding the real estate. We leverage numerous sources to:

- Establish a view of where real estate markets are today and where they will be in the future

- Establish a concrete understanding of a company’s strategy

- Establish a view on the quality of management

- Establish a view on the quality of the underlying real estate and cash flow stream

At the same time, we incorporate top down considerations into our underwriting, valuation framework and thought process such as changes in macroeconomic conditions and monetary policy, financing conditions, political risk, currency and equity market volatility, rule of law and country leverage to name a few.