Our Commitment

We adopt good stewardship practices to ensure we invest responsibly on behalf of our clients.

Our process involves:

- Incorporating ESG considerations as part of our research and analysis to inform the selection of investments or construction of a portfolio

- Reviewing the nature of the business, its ESG impact and its managerial approach to dealing with ESG issues

- Integrating material ESG considerations into every investment decision and over the holding period of the security

- Engaging with issuers and external managers with the objective of improving ESG performance and disclosures

- Reflecting our ESG beliefs in our proxy voting and stewardship activities

- Reporting our ESG approach and performance in our reporting to investors

Our Process

We are focused on delivering superior risk-adjusted returns for our clients over the long-term by investing in public real estate companies that we believe will create significant value over time.

We also recognize the potential for enhanced return and/or reduced risks when we invest in companies with strong ESG business practices

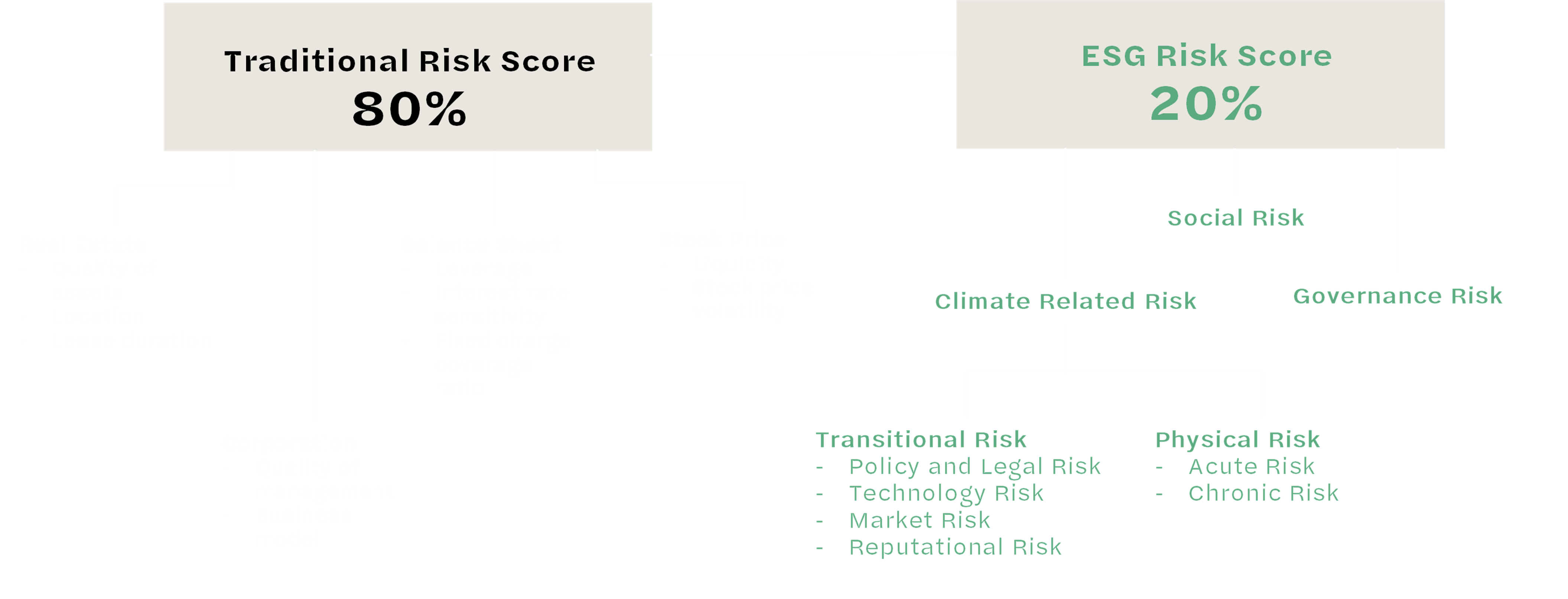

This is why our proprietary risk analysis used to value investment opportunities places a material weighting behind critical ESG factors.

Where We Start

Third party scoring available through Bloomberg or SNL serve as a helpful starting point in evaluating ESG risks. Through these tools we have access to:

- Ratings

- GRI Standard Reporting

- PRI

- S&P Global ESG Rank

- GRESB Rating

- Sustainalytics Rank

- Bloomberg disclosure Score

- ISS governance quality Score

- Anti/Bribery Corruption policy

- Minorities/Women in Management and Board

- CDP Climate Score

- GHG Gas Emissions

- Water intensity / policy

- Waste management

- Energy intensity

- Social Initiatives

- Training Policy

- Gender diversity

Digging Deeper

With the understanding that third-party scoring can be infrequent and imperfect, we believe it is important to dig deeper and look behind the numbers.

We actively engage with management teams to better understand their ratings and their longer-term plans.

This approach has helped us find opportunities to invest in progressive companies where their ESG efforts have not yet been reflected in public scores.

As a responsible allocator of capital, we are also committed to being part of the solution to improving transparency and positively influencing market participants.